Livestock Values and Trends for 2023

The National standard costs 2023 and 2023 Herd Scheme Values are now released by Inland Revenue. We’ve prepared a report on trends in livestock values for the 2023 year compared to prior years.

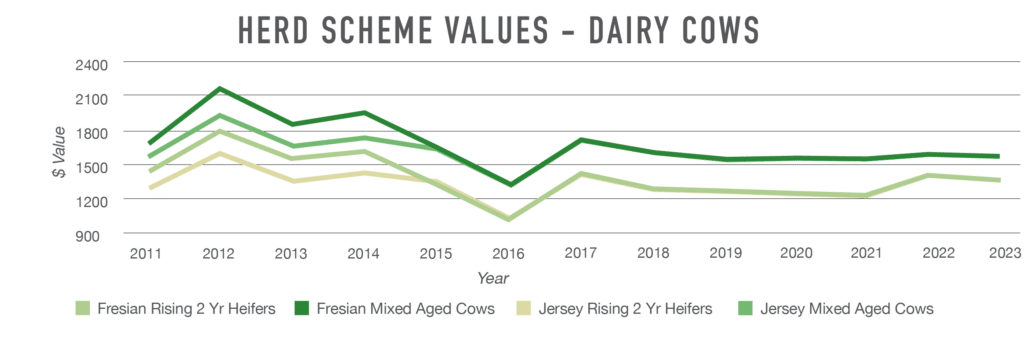

Dairy cattle

All female classes of dairy cattle have declined this year, while there have been increases in all male classes. The decrease in R1 heifer values can be attributed to the ban on live exports by sea in April 2023.

Of note, for the first time the Herd Scheme value for R1 Heifers is lower than the National Standard Cost of breeding and rearing an R1 Heifer.

Mixed Age Dairy cow values have fallen 4.1%, to $1,628 compared to $1,697 last year.

Rising one and two-year heifers have also decreased in value by 14.3% and 2.4% respectively, to $693 and $1,436.

Demand for dairy products remains relatively strong globally, however it is expected that the farm gate milk price for the 2023-24 season will be well down from the highs of 2022-23. This will flow on to dairy cow values; low milk gate prices and continued inflationary pressures for farm input costs will drive down livestock demand.

On-farm emissions reporting is still an unknown which adds volatility – also diminishing the value of dairy cattle.

On the upside we’re seeing some relaxation of the immigration rules. Labour supply has been particularly tight the last two seasons. This won’t be an immediate fix, but the 2024 season should see more migrants joining the payroll again.

Total cow numbers have decreased again this year, as did per-cow production. We can blame the weather for that. Output is back down to 2019-20 levels.

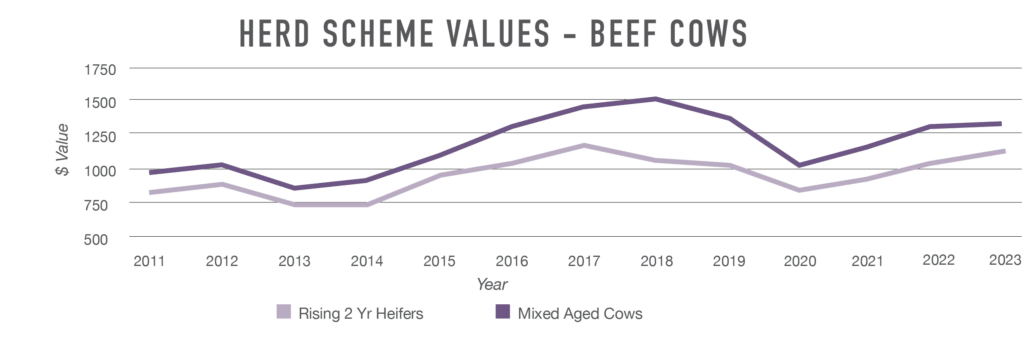

Beef cattle

In contrast to Dairy values Beef values have increased on average 9% and are almost at record values for all classes.

The 2022-2023 year was one of transition for beef cattle. Export prices were weak in the first half but have improved substantially thanks to tight supply worldwide.

Meat works are continuing to struggle to keep up with processing demand. Employee absences are a recurring hangover from COVID-19 which is proving difficult to shake. The meat works capacity issues have caused farmers to be unable to realise the best price for their cattle.

Like the dairy sector, there is still some uncertainty. Domestically the regulatory requirements around water quality, fencing and carbon will be coming into force in the coming years. Global pressures include the rise in popularity of alternative proteins.

Sheep

2022 was the record year for sheep values. These have “corrected” downwards an average of 10.2%. Despite this decrease, they are still the second or third highest that they have ever been depending the class.

The 2022 season inspired optimism for continued high meat prices. These didn’t eventuate in the first half of the year, although prices have seen a recovery as global supply remains limited. This limited supply is keeping prices above historical averages, but it may not continue in the long term.

Wool markets remain uncertain and forecast prices closely match the previous season. Shearing costs are increasing and wool is still generally uneconomical.

Goats

Goat values have increased on average 7.8% with almost all classes of fibre and meat producing goats at record highs.

Female milking goats have continued their decline, down a further 3.7% this year for a cumulative 28.3% drop since 2021. 2023 values are less than half the highest value for female milking goats.

The value of female breeding goats continues to be impacted by the collapse in milk solid returns in 2022 and the reduced quota entitlement.

In spite of this, breeding bucks are at their highest value.

(No graph available)

Deer

Deer values are continuing to recover from the deep lows of 2021. Red Deer, Wapiti, and related breeds averaged a 16% increase. The velvet market has also contributed to an increase in values and there is optimism that these trends will continue.

Other deer breeds have, on average, fallen back from the gains made in 2022. These other breeds are mostly valued by the hunting and trophy trade which was significantly impacted by COVID-19. We expect values to recover to pre COVID-19 levels as trophy tourism also does.

General

You will need to consider your livestock election choices carefully. We will help with this. Even though changes were made to the Herd scheme in recent years, there is still flexibility around how to value increases in numbers. If you increase your numbers during the year, you can choose an alternative valuation option to value that increase. Whether you take that option or elect to value the increase using herd values will depend on several factors, such as:

- where we are in the cycle of livestock values

(e.g. at the bottom, or at the top) - if the increase is a permanent or a temporary one

- your long-term intentions

As the decision is clearly one that should be made on a case-by-case basis, we will naturally discuss your valuation options with you on review of your 2023 Financial Statements and Taxation Returns or at any other time.

Please feel free to contact us about your livestock values.